Tax Protest Cheat Sheet

DOWNLOAD COPY

Collin Central Appraisal District

250 Eldorado Pkwy

McKinney, Texas 75069

(469) 742-9200

https://www.collincad.org/

I've saved the most helpful YouTube videos I've seen and put them under my Playlist Property Taxes youtube.com/c/Teamduffy The non-YouTube videos and links are on my website www.TeamDuffy.com/Protest

See below my TIPS for important steps or explanations not to forget.

Filing a Protest If your form has an eFile PIN in the upper right-hand corner then you can file electronically after registering.

-

Collect your evidence (see below for how to collect)

-

Go to https://efileprotest.collincad.org Register/Login Choose E-File Protest from the upper left-hand menu.

-

Click the E-File button next to your property ID in the Current Year Property List.

-

In the E-File Protest Information screen, select the reasons why you disagree with the value or content of your appraisal notice.

TIP Be sure to check the boxes for both market value and unequal appraisal

-

Fill in the comment box - Write what evidence you have showing the price should be less or your repairs that make your house less.

-

Enter your Opinion of Value.

TIP Once you find the low selling homes calculate the square foot (sqft) value of those homes to figure what yours should be. To do that take the sales price, deduct any seller concessions (amount paid by the seller for the buyer) to end up with the net selling price. Take that number and divide by how many sqft that home has. This is the sold price per square foot that you can now multiply by your homes sqft to get a more equal apples to apples value.

-

Click Submit. Review the information provided in the Create Protest Summary screen, to make changes to your protest, click Edit. When you are finished editing your protest, click Create. (see screenshots below)

-

Once you have filed your protest send an email requesting for their evidence used in your home's value.

Which is their own appraised value of everyone else in the subdivision

See sample email below. Send to: evidence@cadcollin.orgTIP Evidence requested and not made available to the protesting party at least 14 days before the scheduled or postponed hearing may not be used as evidence in the hearing, according to 41.67d of the Texas Property Tax Code.

YOUR EVIDENCE

To find out the sold price ranges and get monthly market alerts to use for your evidence go to https://TeamDuffy.com/Neighborhood I made an easy how to setup for protest that's also on my YouTube channel (YouTube.com/TeamDuffy). You can also contact me call/text/email/online for me to run comps.

Pick the lowest selling sold comparable homes that are as close to yours as possible - Same subdivision, one/two story, pool, year built, number of rooms.

TIP When comparing your home to others square feet (sqft) makes a huge difference. Appraisers when purchasing a home will only go a few hundred sqft above and below. If their evidence compares your home to one that is much larger, and they didn't give a reduction for it make sure you calculate the price per sqft from above tip and introduce that at hearing.

Written – As you're collecting evidence write down addresses, reasons why your house is better or worse than specific homes sold during that tax year. You will write that in the comment section on the initial filing of your protest. You will have the option to upload evidence.

Pictures are worth a thousand words – Take pictures of any disrepair on your property and of any "negative influences" surrounding your property. Qualified negative influences could be busy streets, water tower looming over your house, sewer plant nearby, commercial property bordering your residential, etc. Your noisy neighbors junked out car and overgrown grass probably will not qualify!

Google Earth is a wonderful thing. I would recommend printing a satellite view of your property and the surrounding area. Probably 85% of the time you can find something negative to talk about on the image! It could be anything. Get creative and add support to the rest of your presentation.

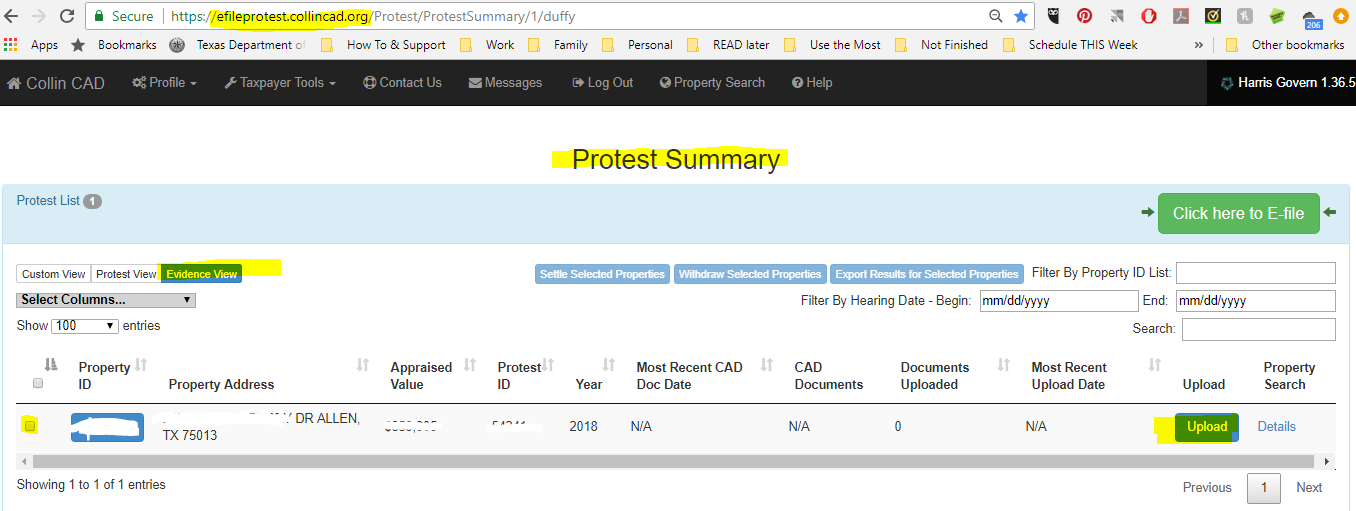

Adding, Viewing Documents and Protest Status

Within one hour you should get email allowing you to go back hit Evidence button in bar then upload comps or pictures of your defects or comparable (see how to screenshot)

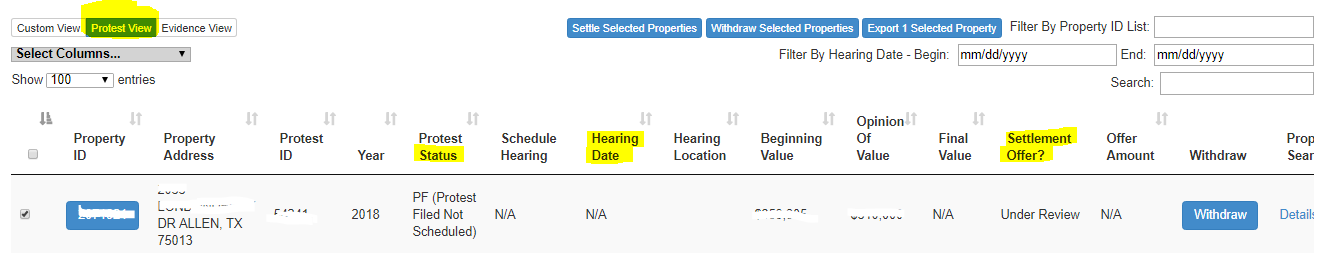

Check back to site often to view status and if a hearing is scheduled or a settlement offer has been given. You are supposed to receive an email or phone call but from first hand experience don't trust that just check the site.

SAMPLE EMAIL requesting Evidence

The appraisal district must provide the evidence to you 14 days prior to your hearing if requested. This is the law. And often, their evidence supports a reduction but more importantly this locks in their evidence so they can't make changes.

To: evidence@cadcollin.org

Re: House Bill 201 request for property at 2345 Main Street (account # 1234567890010)

Please provide a copy of the data, schedules, formulas, and any other information that the appraisal district plans to introduce at the hearing for my property.

Please notify me either by email or phone (enter your phone number) when a copy of the above-referenced information is available.

Sincerely,

Able Property Owner

The Scoop on hiring someone to file for you:

A great site to see what kind of luck you'll have is propertytax.io which is free. If you choose to they'll organize and give you all the information which is between $75-99.

Another program I found (not affiliated with or personally used but I really like the information they give, YouTube videos and nice customer service) their site is https://www.cutmytaxes.com/ for people who do not have time to file. This is better than not filing at all.

This program works best for people who pay their property taxes in one lump sum every year. You enroll once at no cost and they protest for you every year. Here is what they tell me on how their fee works: If they got your taxes lowered 10k multiply by last year tax rate say 3% so $300 tax savings so you owe them $150.

TIP: You will owe them that amount immediately so IF you escrow for your taxes I would ask your mortgage company first if you get property taxes lowered and there is money left in your escrow account will they refund you. Also, remember unless the attorney gets it lowered BELOW the previous years' property tax amount then it is likely you won't have any money left in your escrow account since property taxes are paid in arrears. This means although you'll not have an increase in your monthly mortgage payments because your taxes went up so much you still must pay this attorney his 50% cut at the time that he gets you the reduction.

Chances to get the value reduced:

Here is how the offers typically work. I say typically because with covid everything is changing.

-

Once you get everything in system you might get an immediate reduction then you can request their evidence.

-

Schedule a time or just go up there (if allowed with covid) and ask to speak to one of the appraisers. Here's your second and best chance to get a reduction. If they don't lower at that time, then you request a hearing.

-

Before the hearing (sometimes even day before) they could offer you a reduction to not do the hearing. I personally was scared like a 10-year-old schoolgirl to do this hearing, so I would always take the deal. When I finally did go, I would like to say it was stress free but if you're like me and don't like public speaking your nerves will be shot! There is typically just the 4 people all sitting at computers with you reviewing what you present but other homeowners also protesting can be sitting right behind you.

-

Typically, you will get one more chance for a price reduction minutes before it starts BUT that's not guaranteed so I wouldn't bank on it.

-

Your best shot of winning at the actual hearing is in showing that your house is LESS than the other comparable homes usually in the way of repairs. I protested that my house was on the end of the street next to a bigger loud street therefore my house would most likely sell for less. Although I shot myself in the foot on that one because I had sold my neighbor's house across the street for 20k more than appraised value but hopefully you'll have better luck!

Collin CAD (Central Appraisal District) customer service has always been quick and friendly when I've called so if you have specific questions about your property give them a call. (469) 742-9200

Feel free to contact me if there is anything I can help with! If you'd like me to pull comps for you go to my protest page and hit the contact Alicia!

Please pass on my information to anyone you know in your community because the more people who protest the better for everyone!

If you happen to have any friends or family thinking about making a move in the next year, I'd love to send them my timeline for a stress-free move!

Best of Luck and I'd love to hear how it went!

Alicia Duffy, Realtor

TeamDuffy.com

Texas Urban Living, Realty Plano

214-682-5009

Links:

YouTube.com/c/Teamduffy (Playlist Property Taxes),

https://TeamDuffy.com/protest

https://TeamDuffy.com/propertytaxes

https://efileprotest.collincad.org

https://www.collincad.org/

ESSENTIAL BUSINESS/REAL ESTATE

e: marissaoberrysales@gmail.com

w: https://marissaromack.webpro-realty.com

a: 1420 South Florida Ave Lakeland FL 33803

DOWNLOAD MY HOME SEARCH APP!

1101 S. Winchester Blvd., Ste J-225 San Jose, CA 95128